Buying a home in California can feel out of reach—especially when saving for a down payment. The California Housing Finance Agency (CalHFA) is bringing back one of its most impactful programs to help change that.

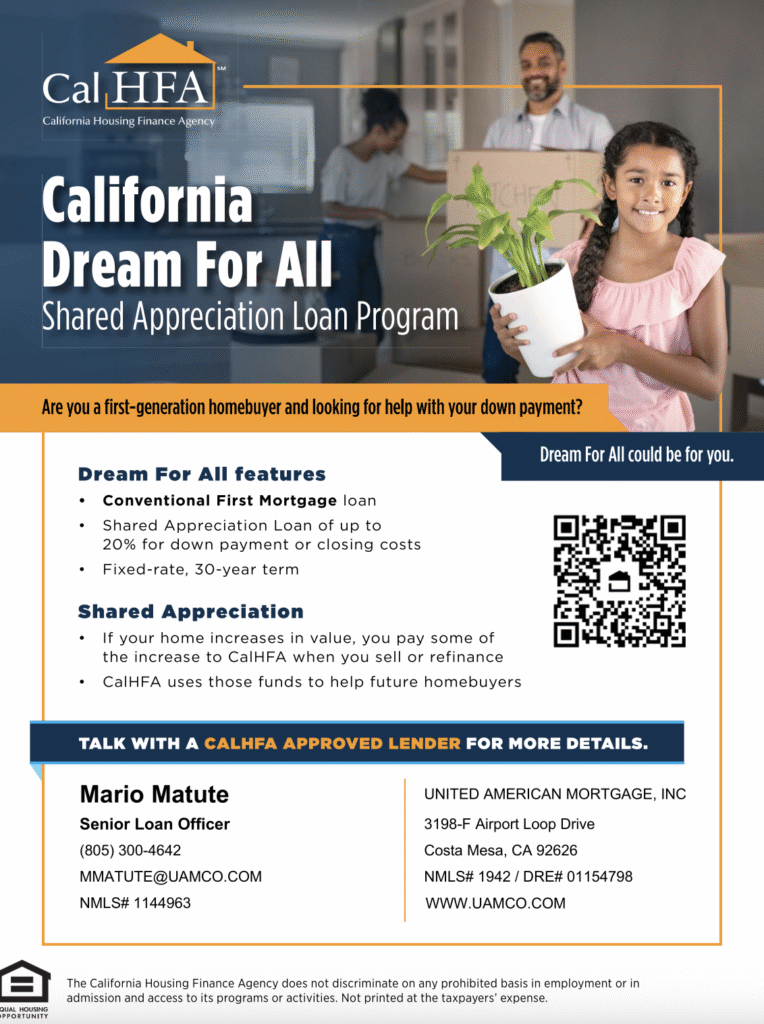

The California Dream For All Shared Appreciation Loan Program will begin accepting applications February 24 through March 16, offering eligible first-generation homebuyers up to 20% of the home’s purchase price or appraised value toward their down payment or closing costs.

How the Dream For All Program Works

Dream For All is designed specifically for first-generation homebuyers—those who have never owned a home and whose parents did not own a home in the U.S. at the time of the applicant’s birth. The program pairs a 30-year fixed-rate first mortgage with a shared appreciation loan for the down payment.

Instead of monthly payments, the shared appreciation loan is repaid when the home is sold, refinanced, or the first mortgage is paid off. At that time, the homeowner repays the original assistance plus a portion of the home’s appreciation. Those funds are then recycled to help future buyers.

Why This Program Is a Game-Changer

By providing a substantial down payment, Dream For All can:

Eliminate the need for mortgage insurance

Lower monthly mortgage payments

Improve purchasing power in competitive markets

According to California Forward, this structure can save the average buyer about $1,200 per month, making long-term homeownership more sustainable.

What to Expect for 2026

CalHFA anticipates allocating $150–$200 million for this round. Applications will be chosen through a random selection process to ensure equitable distribution of funds. Per Governor Newsom’s directive, at least 10% of funds will go to applicants in Qualified Census Tracts. Once selected and conditionally approved, buyers will have 90 days to shop for a home.

Preparing to Apply

Income limits apply and vary by county (for example, approximately $168,000 in Los Angeles County). Applicants must work with a CalHFA-approved lender to obtain a pre-approval letter before applying. Additional required documents include a government-issued ID and parent information.

👉 Use the QR code included in this article to access the official Dream For All webpage, where you’ll find the complete eligibility checklist, document requirements, and lender resources.

If you’re a first-generation buyer thinking about homeownership in 2026, now is the time to prepare. This program has the potential to open doors—and change lives.

Leave a Reply